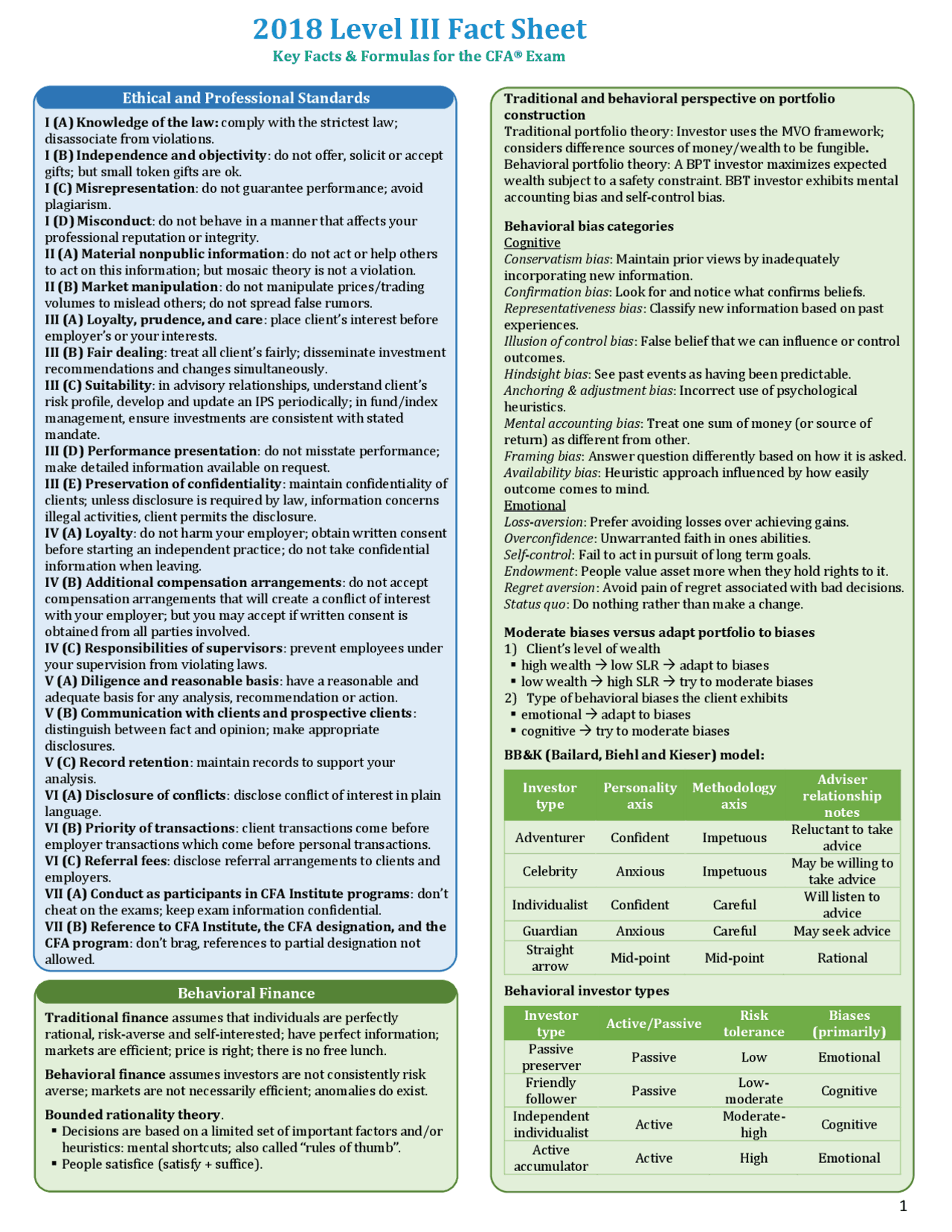

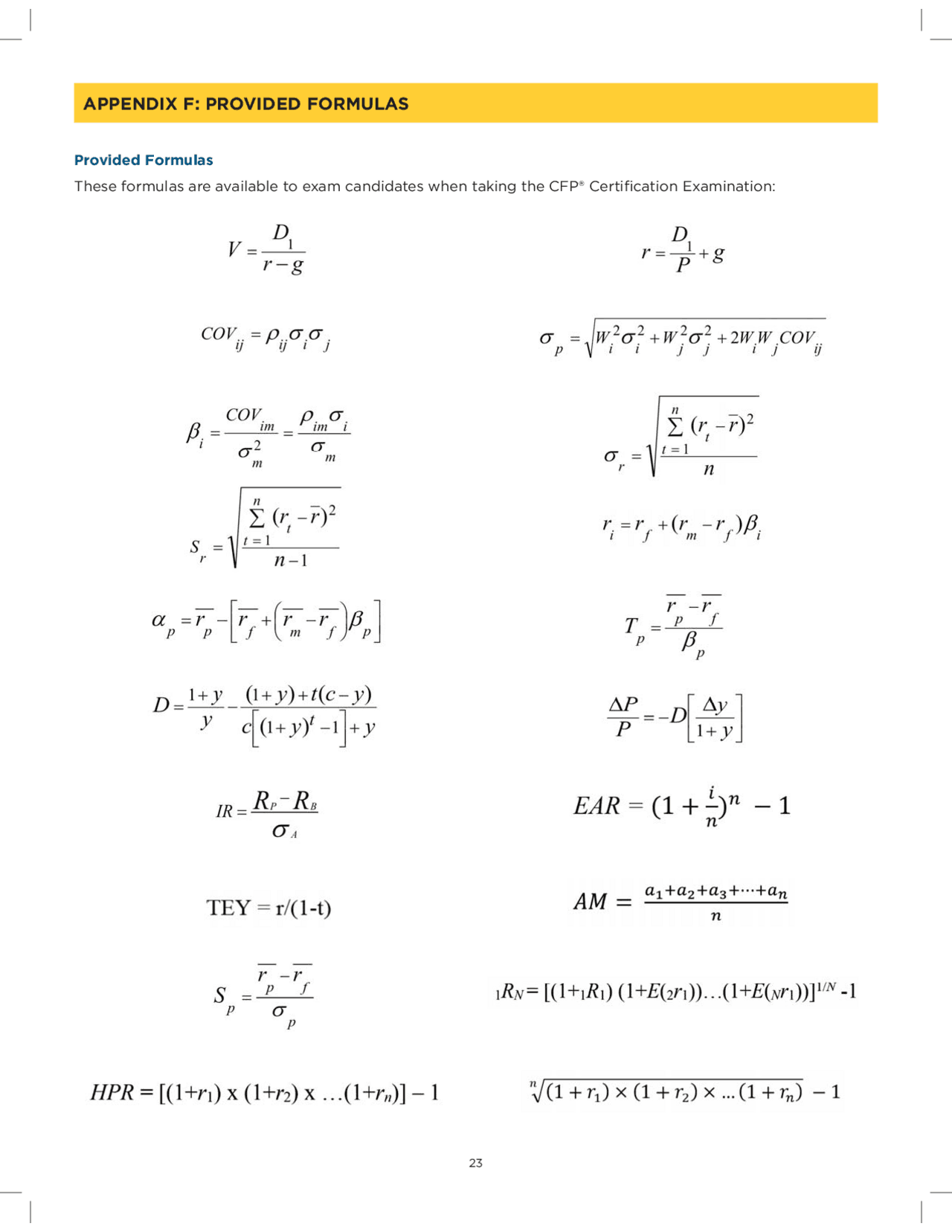

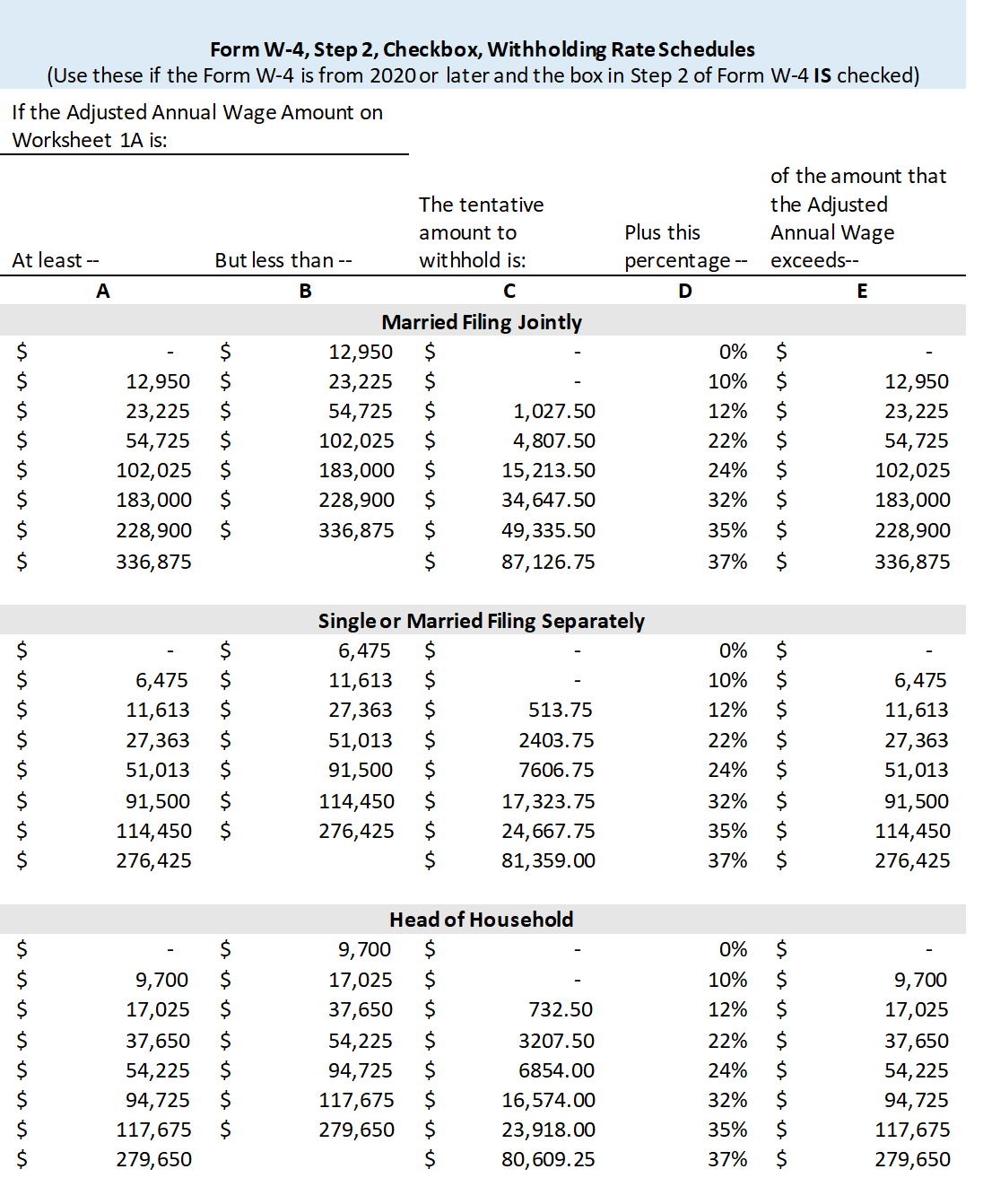

Cfp Board Formula Sheet - Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. The table below outlines the changes to the sheet. These formulas are available to candidates. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Take advantage of these unique study tools to help you prepare for the cfp® certification examination. Tax table and formula materials are provided below to help you prepare for the cfp® exam.

2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Take advantage of these unique study tools to help you prepare for the cfp® certification examination. The table below outlines the changes to the sheet. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Tax table and formula materials are provided below to help you prepare for the cfp® exam. These formulas are available to candidates.

The table below outlines the changes to the sheet. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Tax table and formula materials are provided below to help you prepare for the cfp® exam. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 These formulas are available to candidates.

CFP Board Fixes Financial Formulas Money Education

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Tax table and formula materials are provided below to help you prepare for the cfp® exam. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0.

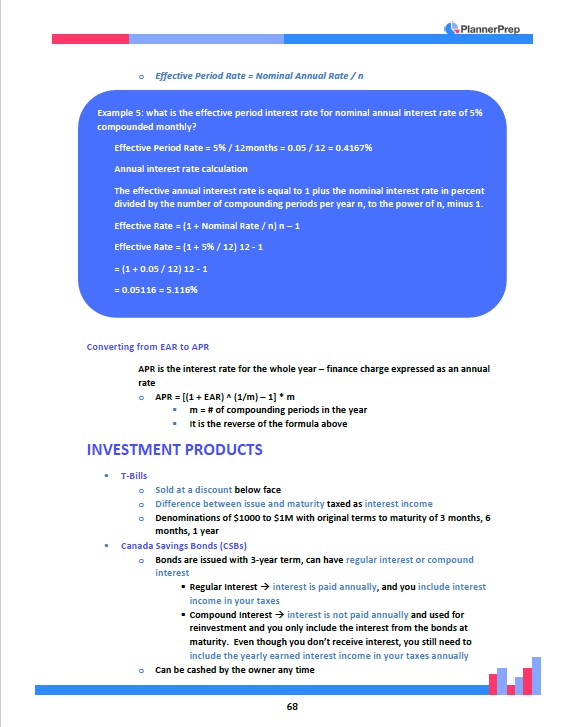

CFP Exams Question Bank and QAFP/CFP Study Guide PlannerPrep

Take advantage of these unique study tools to help you prepare for the cfp® certification examination. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 These formulas are available to candidates. Tax table and formula materials are.

Cfp 2024 Formula Sheet Download Pet Lynnell

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0.

CFP formula sheet Cheat Sheet Financial Accounting Docsity

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. These formulas are available to candidates. Tax table and formula materials are provided below to help you prepare for the cfp® exam. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. 2 2024 married filing.

Formula sheet

These formulas are available to candidates. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. The table below outlines the changes to the sheet. Tax table and formula materials are provided below to help you prepare for the cfp® exam. 2 2024 married filing separately taxable income over but not over pay +.

Cfp Formula Sheet 2024 Davine Jordan

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. Tax table and formula materials are provided below to help you prepare for the cfp® exam. These formulas are available to candidates. The table below outlines.

CFP Formulas Correlation YouTube

Take advantage of these unique study tools to help you prepare for the cfp® certification examination. The table below outlines the changes to the sheet. Tax table and formula materials are provided below to help you prepare for the cfp® exam. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount.

Education & Resources Creative Financial Strategies

These formulas are available to candidates. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Take advantage of these unique study tools to help you prepare for the cfp® certification examination. Tax table and formula materials are.

Cfp Tax Tables 2024 Formula Sheet Kinna Marianna

These formulas are available to candidates. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. The table below outlines the changes to the sheet. Tax table and formula materials are provided below to help you prepare for the cfp® exam. 2 2024 married filing separately taxable income over but not over pay +.

What Can You Do with a CFP Certification in Malaysia?

Tax table and formula materials are provided below to help you prepare for the cfp® exam. These formulas are available to candidates. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Take advantage of these unique study tools to help you prepare for the cfp® certification examination. The table below outlines.

Cfp Board Has Recently Updated Its Investment Formulas Sheet, Which Is Provided To Candidates Taking The Cfp Exam.

Take advantage of these unique study tools to help you prepare for the cfp® certification examination. Tax table and formula materials are provided below to help you prepare for the cfp® exam. These formulas are available to candidates. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600