Goodwill Balance Sheet - Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. It is easily available on the balance sheet.

It is easily available on the balance sheet. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is.

It is easily available on the balance sheet. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non.

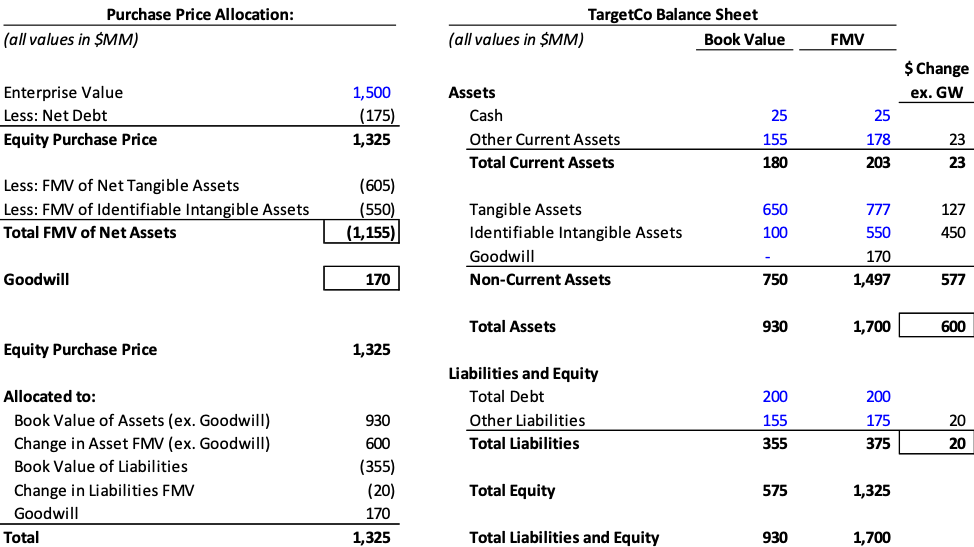

Goodwill in Finance Definition, Calculation, Formula

It is easily available on the balance sheet. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is.

Accounting for goodwill ACCA Global

It is easily available on the balance sheet. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non.

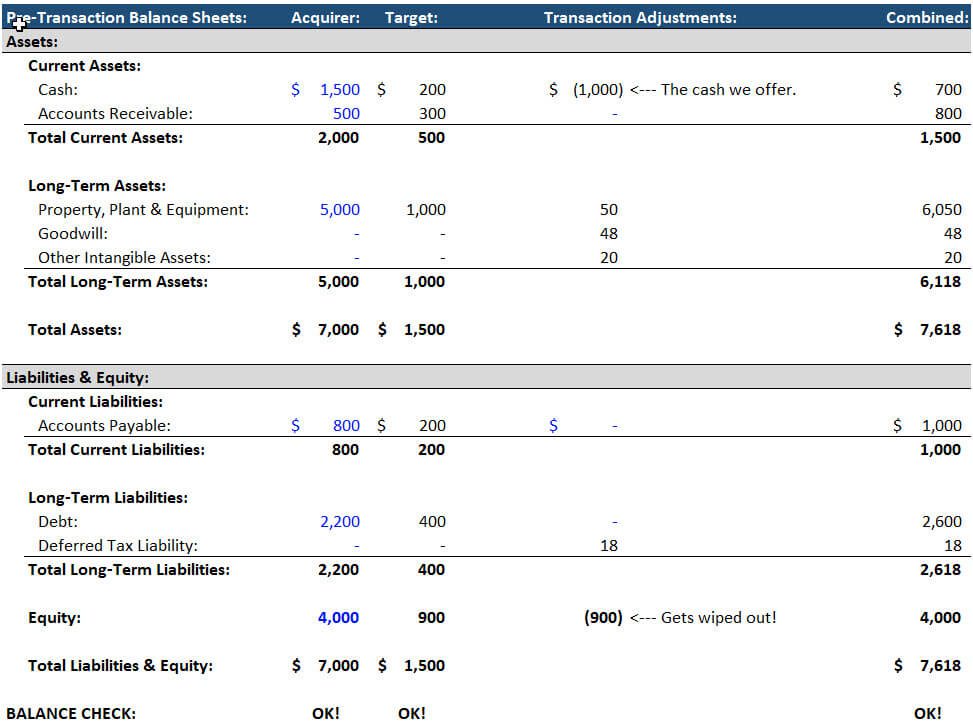

How to Calculate Goodwill Video Tutorial, Examples, and Excel Files

Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. It is easily available on the balance sheet.

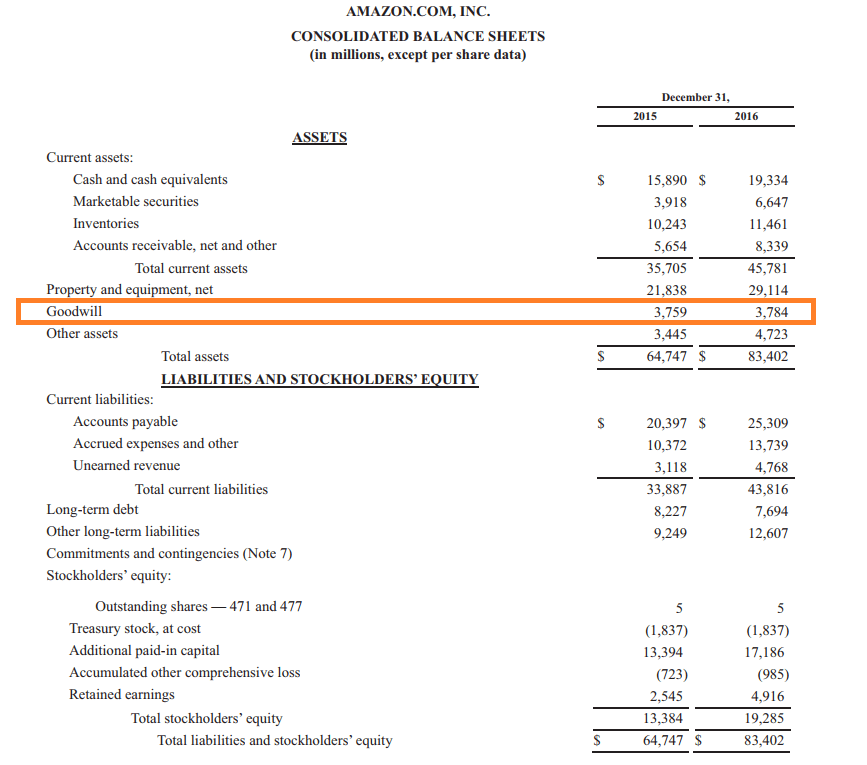

Balance Sheet Highlights

It is easily available on the balance sheet. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is.

Accounting Goodwill Analyzing a Balance Sheet Investing Post

It is easily available on the balance sheet. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is.

Which of the Following Properly Describes the Accounting for Goodwill

It is easily available on the balance sheet. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non.

How to Account for Goodwill A StepbyStep Accounting Guide

Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. It is easily available on the balance sheet.

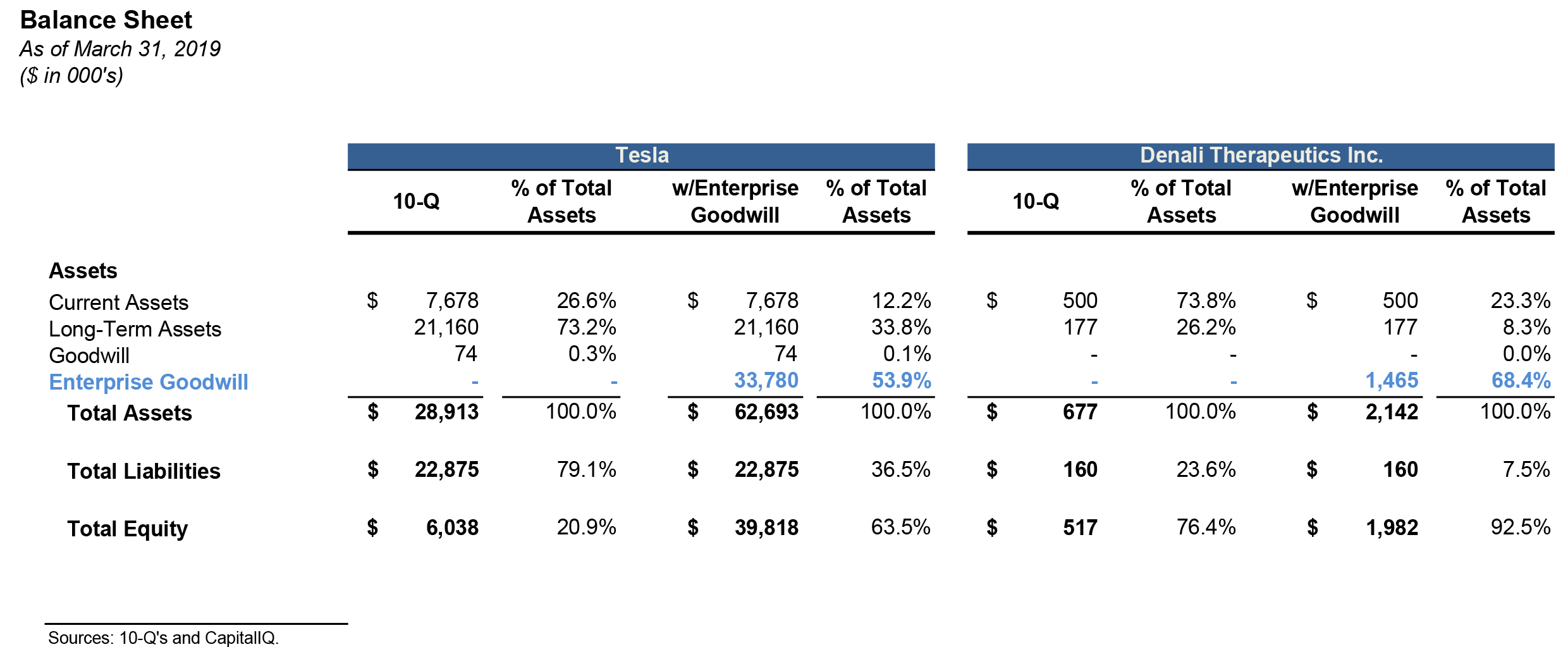

Redefining Goodwill To Save Balance Sheet Sorbus Advisors LLC

Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is. It is easily available on the balance sheet.

PPT Northrop Grumman Corporation PowerPoint Presentation, free

It is easily available on the balance sheet. Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is.

It Is Easily Available On The Balance Sheet.

Finally, the goodwill equation is calculated by adding the consideration paid (step 1), non. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is.