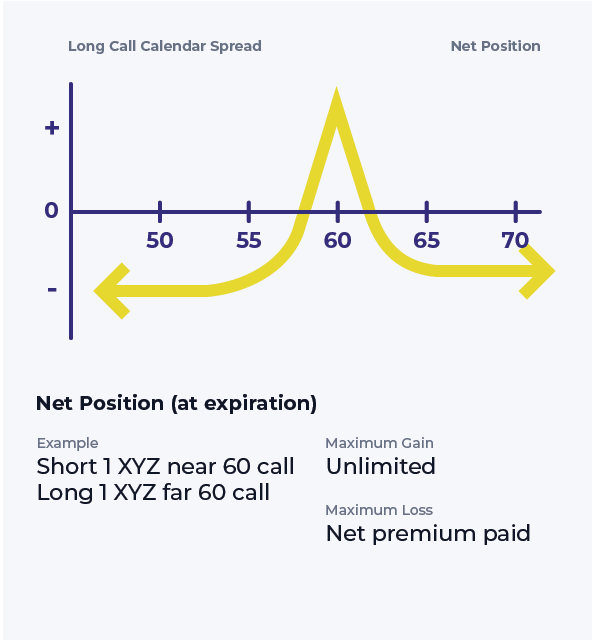

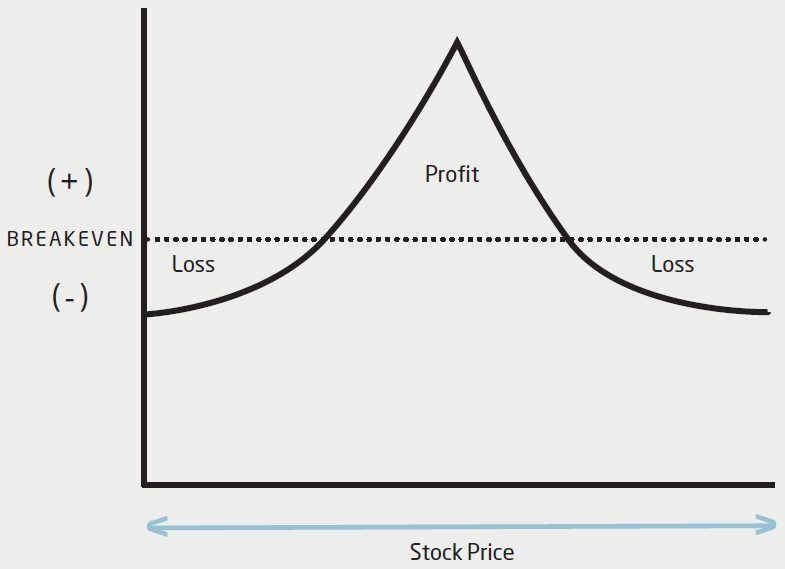

Long Call Calendar Spread - This strategy involves buying a longer. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at.

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. This strategy involves buying a longer. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one.

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at.

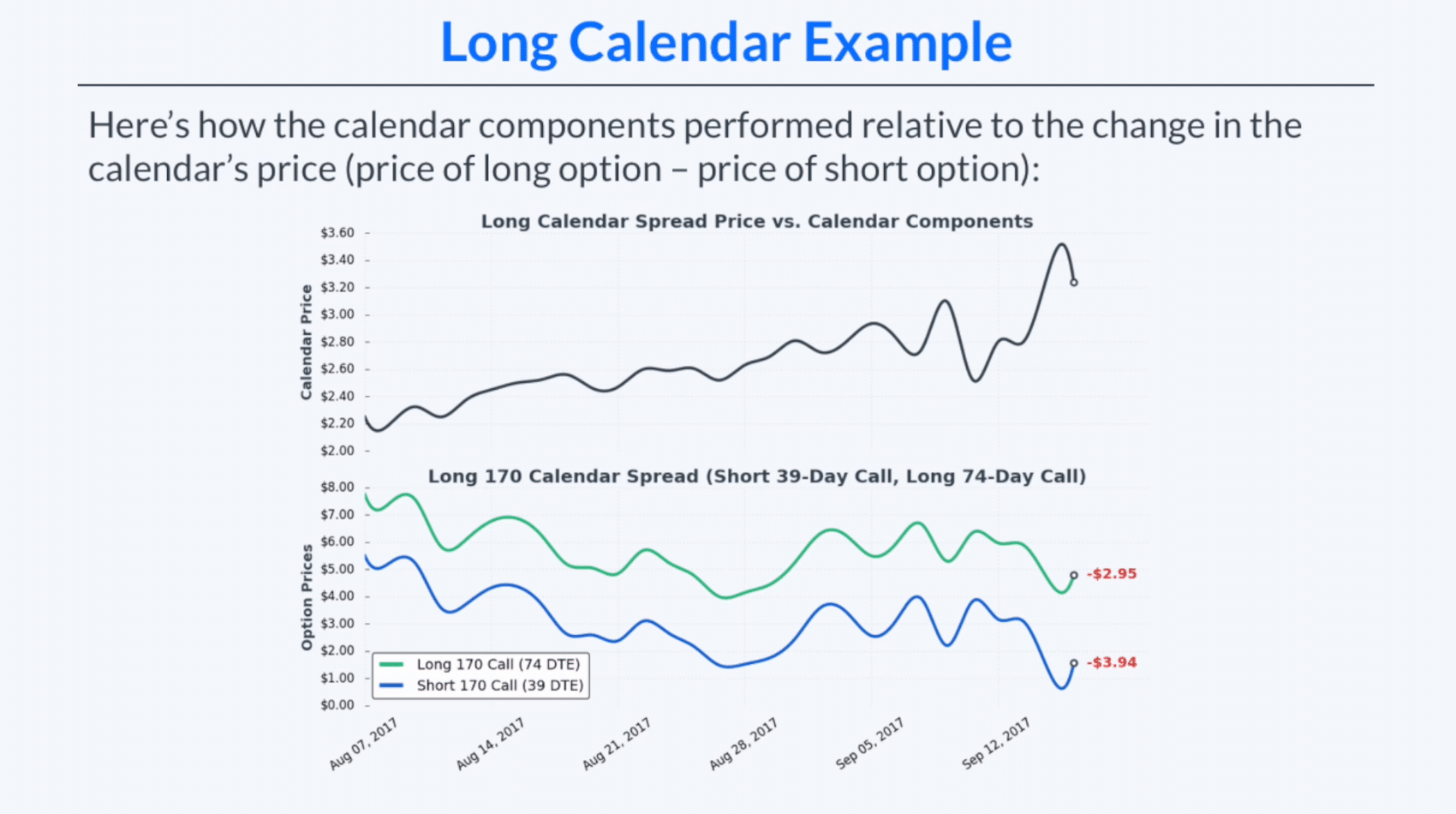

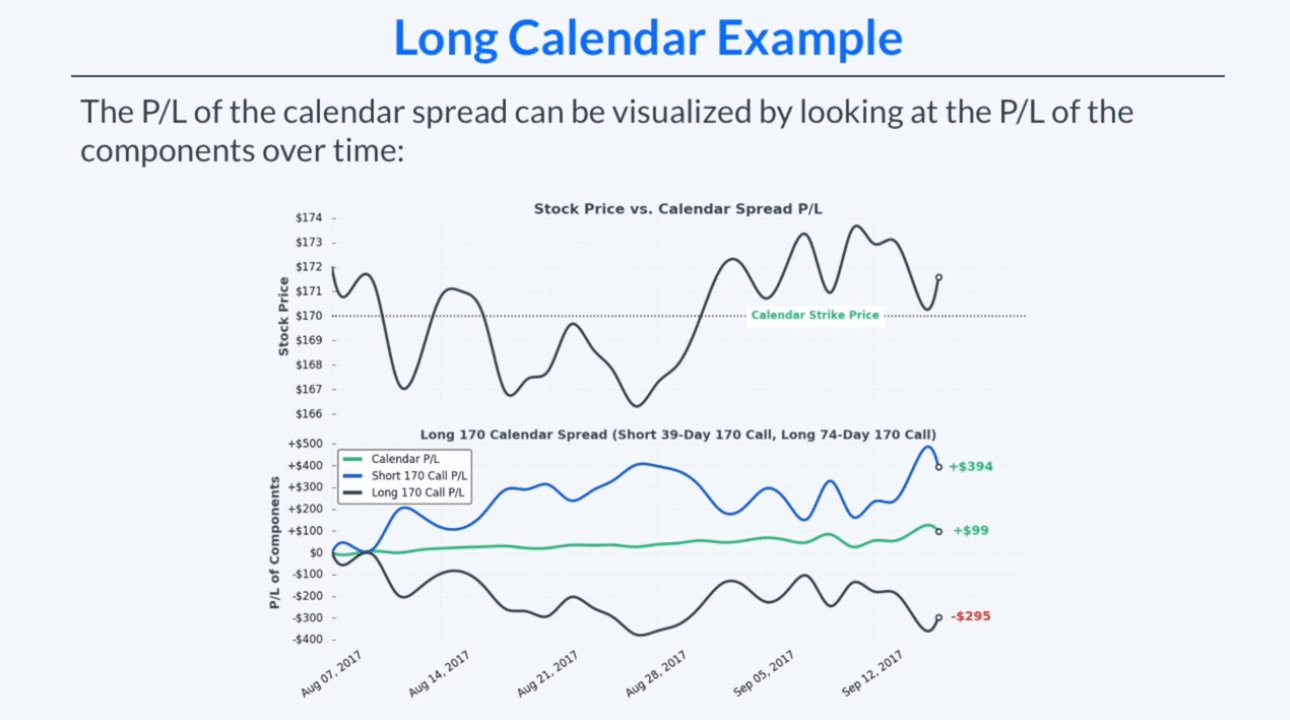

Long Calendar Spread with Calls Strategy With Example

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread involves buying and selling call options for the same underlying.

Long Calendar Spread with Calls

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use a long call calendar spread to combine.

Long Calendar Spreads for Beginner Options Traders projectfinance

This strategy involves buying a longer. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long call calendar spread involves buying and selling call.

Long Calendar Spreads for Beginner Options Traders projectfinance

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long call calendar spread.

Long Calendar Spreads Unofficed

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Learn how to create and manage a long calendar spread with calls, a strategy that profits.

Long Call Calendar Spread PDF Greeks (Finance) Option (Finance)

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long calendar call spread is seasoned option strategy where you sell and buy same.

Long Call Calendar Spread Options Strategy

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. A long calendar call spread is.

How to Trade Options Calendar Spreads (Visuals and Examples)

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. Learn how to use a long.

Calendar Call Spread Options Edge

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is.

The Long Calendar Spread Explained 1 Options Trading Software

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use a long call calendar spread to combine a.

A Long Calendar Call Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Calls With The Purchased Call Expiring One.

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at.